The OCBC Frank Card was one of my favourite Credit Cards! It allowed me to stretch my dollar from all my online spending. Giving me up to 6% on my online spending and an unlimited cash back of 0.5% on all other spend. It even made it to the list of the best cash back credit cards !

|

| A Frank SMS |

Tsk, Tsk. So sneaky.

Similar to the changes made to the UOB One Card, OCBC has revised some of the cash back rate, sadly it made the card less competitive.

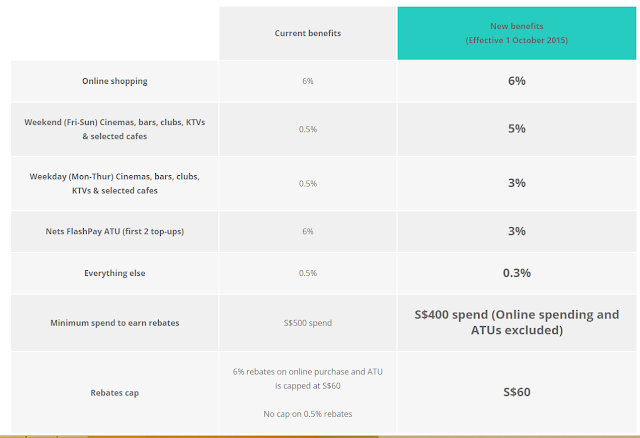

Let us break down the changes from 1st October.

Frank Cashback Changes

1) The main point to note is the removal of the "No Cap on 0.5% rebates".

This essentially means that once you've hit the S$60 spending rebate from any of the criteria, you will no longer be eligible for more rebates!

2) Weekend/Weekday Dining, Entertainment rebates, increased to 5% and 3% respectively.

With all due respect, there is already a card for that. Its call the OCBC365. Incorporating this aspect into a pure spending/cashback card simply diminishes the function of the Frank Card.

3) Minimum spend to earn rebates, reduced to S$400.

Well its great that they reduce the minimum spend amount. But if you are a financially savvy customer, you would have an OCBC360 account and one of the terms for the OCBC360 additional interest criteria is to spend S$500 on your OCBC credit cards. Reducing the min. spend to earn rebates does not really do much in this case.

4) Minimum spend to exclude Online and Nets Flashpay ATUs spending

This is perhaps the nail-in-the-coffin for this card! If it was already hard to achieve the min. spend amount, especially if the bulk of your spending are from online shopping, then it would be impossible to qualify for the rebates at all!

With this 'hidden' criteria, you would need to spend S$400 from "KTVs, Cinemas, Bars and some cafes" and "everything else" each month, to qualify for rebates.

With this 'hidden' criteria, you would need to spend S$400 from "KTVs, Cinemas, Bars and some cafes" and "everything else" each month, to qualify for rebates.

A Frank Summary

I guess all good things must come to an end. The revision of the terms really makes this card lose out to its cashback peers, like the UOB One Card and the SCB Manhattan card. The only saving grace for the Frank Card is that many holders are also OCBC360 account holders. In any case, i would expect quite an exodus of users from the Frank Card - i myself would be looking at other OCBC rebate Cards (OCBC Cashflo).

Stay tuned for a shoot-out of the latest cash back cards available!